Frequently Asked Questions (FAQs)

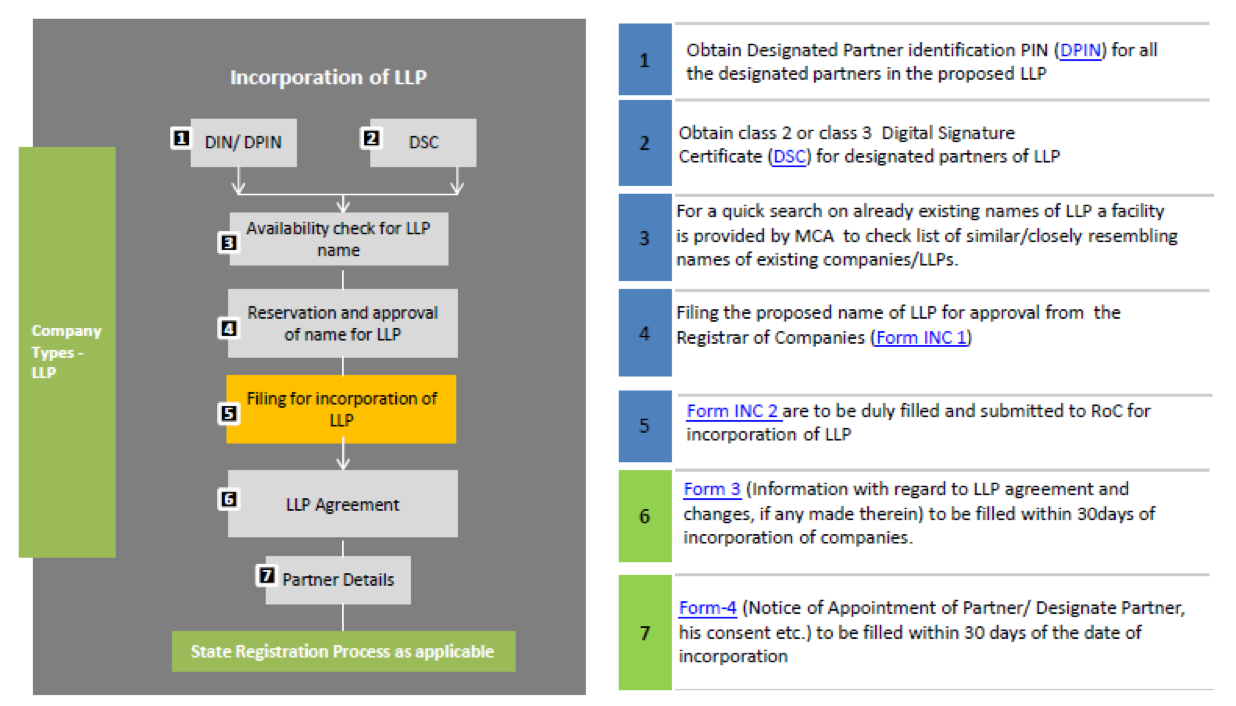

Yes, any LLP can close down its business in India by adopting any of the following two ways:

1. Declaring the LLP as Defunct: In case the LLP wants to close down its business or where it is not carrying on any business operations for the period of one year or more, it can make an application to the Registrar for declaring the LLP as defunct and removing the name of the LLP from its register of LLP’s.

2. Winding up of LLP: It is the process where all the assets of the business are disposed-off to meet the liabilities of the same and surplus any, is distributed among the owners. The details of LLP closure can be seen from the following link-(http://www.mca.gov.in/LLP/CloseCompany.html ) LLP’s are subject to LLP Act & Rules the same can be seen from the following links (http://www.mca.gov.in/Ministry/actsbills/pdf/LLP_Act_2008_15jan2009.pdf) &(http://www.mca.gov.in/Ministry/pdf/LLPRulesasnotified.pdf) . Recently RBI has also notified provision for foreign investment in LLP-(http://www.rbi.org.in/scripts/NotificationUser.aspx?Id=8844&Mode=0) LLP’s are not required to have board meetings, AGM etc.

No, director must have an approved DIN to register the DSC on MCA portal.

Foreign directors are required to obtain Digital Signature Certificate from an Indian Certifying Authority (List of Certifying Authorities is available on the MCA portal). The process of registration of DSC is same as applicable to others.

The approved name of LLP shall be valid for a period of 3 months from the date of approval. If the proposed LLP is not incorporated within such period, the name shall be lapsed and will be available for other applicant/ LLP. Please note that there shall not be any provision for renewal of the name.

E-form 3 and e-form 4 are required to be filed for appointment of new and resignation of existing partners within thirty days of such cessation or appointment without additional fee and with additional fee thereafter.

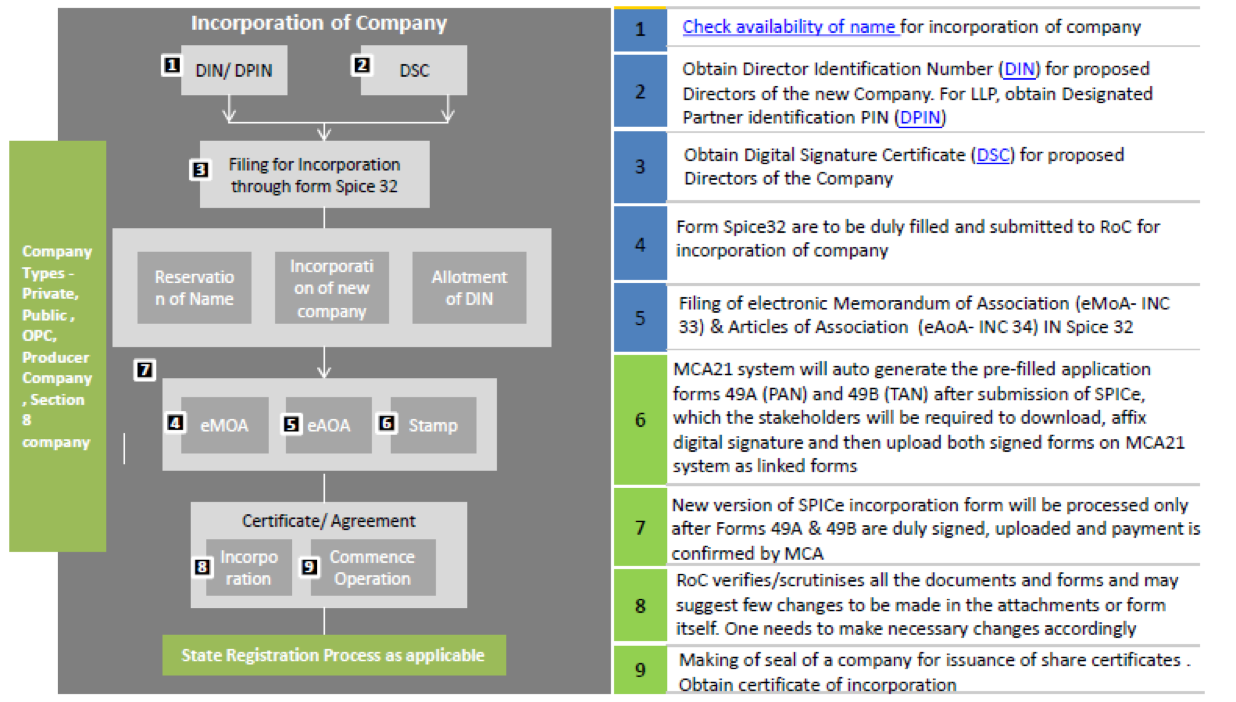

For reservation of a name prior to filing SPICe (INC-32), you may use INC-1 (in which up to 6 names can be proposed) and then input the SRN of approved INC-1 into SPICe.