India’s image as the world’s third largest growing startup ecosystem is gaining momentum. However, one of the key challenges currently faced by startups in India is access to early stage funding. Angel investors fill this crucial gap by investing in early stage companies.

However, another challenge is the levy of tax on such angel investments received by early stage startups.

Department of Industrial Policy and Promotion, the nodal agency assigned to coordinate and oversee the effective and timely implementation of the Startup India initiative, recently rolled out revised startup notification in its efforts to ease the tax liability on private limited companies receiving investments above the company’s fair market value.

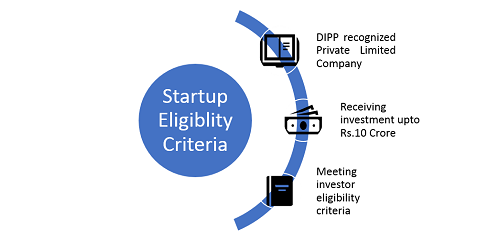

The notification aims to exempt private limited companies recognized as startups by the Department from the tax (commonly known as Angel Tax) only if the aggregate amount of paid up share capital and share premium of the startup after the proposed issue of shares does not exceed ten crore rupees. Any startup which has raised money in the past or/and which has a proposed investment within the above limits may apply for this exemption.

Eligibility criteria for Startups to apply for Angel Tax Exemption

Further, the notification also lays down certain criteria which must be fulfilled by the investors for the startup to claim tax exemption on angel investments. Any resident investor which has invested or propose to invest in the startup should either have the minimum average returned income of twenty-five lakh rupees for the preceding three financial years or have minimum net worth of two crore rupees as on the last date of the preceding financial year.

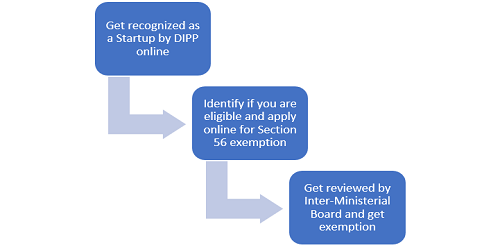

Process for exemption under Section 56 of the IT Act

The application process is simple and effortless. The startup intending to apply for the exemption is required to fill the application form ‘Exemption under Section 56’ along with certain documents. The application majorly requires a report from any of the SEBI registered Category-I merchant bankers specifying the fair market value of shares (as per rule 11UA of Income Tax Rules, 1962). The merchant banker’s report is reliable and inexpensive. It takes as low as Rs. 50,000 to get it made. (Write to us at dipp-startups@nic.in in case you need to find a Merchant Banker in your area)

The application will then be reviewed by an Inter-Ministerial Board constituted by DIPP in April 2016 consisting of members from various departments of the Government. The eight-member Board meets periodically to decide on the received applications.

The Board also evaluates applications received for Income Tax exemption under Section 80 IAC of the Income Tax Act which is granted for any three consecutive years out of a period of seven years from the date of incorporation of the Startup. For this, any Private Limited company or a Limited Liability Partnership registered post 1st of April 2016 is eligible to apply. Currently, 88 startups have been certified eligible for grant of tax exemption under this section.

By rolling out of the amendments in the notification, startups are likely to have easy access to funding which in turn will help in promoting the startup ecosystem in India.

(You can write to us at dipp-startups@nic.in in case of any queries relating to tax exemption application process and eligibility for startups given by DIPP)